De Basement

- Oct 14, 2025

- 3 min read

Having watched prices surge this year, investors might be wondering what gold is saying. Is it higher inflation expectations stemming from tariff-induced price hikes? Is it the threat of regional conflicts spilling over into global wars? Is it the de-globalization of trade creating demand for alternatives from foreign central banks? Is there rampant profligacy of government spending as populist policies expand debt-to-GDP ratios?

Answer: a) Yes. _____

b) No _____

c) All of the above _____

If you answered 'c', you are not alone. The best momentum trade of the past two years - one that has outperformed even the AI mania - is the hardest financial asset the world has ever known. Gold - aka the "archaic relic" of finance - has reclaimed its place as the refuge of choice for nervous investors. Even Bitcoin has struggled in the sharp sell-off this past week. Cryptocurrencies are a 'risk-on' version of gold and, as I posited last week, the seasonal 'risk-off' trade has now arrived.

Gold Miners vs NVDA

The hard asset decade is truly upon us. Fiat assets, which rely on human means of production rather than geology, are slowly descending into the basement of asset allocation. And they will continue to do so until such time as a crisis of confidence arises. At that point, there will be a 'come to Jesus moment for the markets. I don't see that point anytime soon. The Fed is more concerned about the weakening labour market, not inflationary tariffs or, more importantly, the moral hazard of easy money. Tariffs are viewed - correctly, in my opinion - as transitory by the left-leaning FOMC members who hold sway over the committee. They will likely continue to ease policy further as a reflex response to the weakening employment data, if and when it gets reported.

It is up to the long end of the Treasury market to play the role of bad cop here. The flight to safety bid that propelled gold to $4100 also boosted bond prices this week. With inflation sticky, real yields actually are falling. That was the proximate cause of gold's most recent surge. Until such time as yields on government bonds exceed inflation expectations by more than 3%, I see no end to the gold bull market.

As for my other favourite hard asset play, copper, it is being held back relative to gold by the depressant effects of Trumpian trade threats. The arbitrary and unpredictable nature of policy pronouncements from the White House has put a chill on business and consumer confidence. This has created a demand sag in the economically sensitive commodities. Oil prices are cratering due to oversupply. Lumber prices are starting to crack after a tariff adjustment sent them briefly higher. And if it were not for unexpected outages in key mines, copper would be much weaker. The ratio to gold prices is testing lows once again. Only a succesful reflation in a post-tariff environment can reverse this downtrend.

Copper / Gold

So, like many of us, the basement is where you put stuff you don't want. Let's hope U.S. Treasury bonds don't end up there anytime soon. By the time they do, gold should be much higher than it is today.

Risk Model: 2/5 - Risk Off

Although the pull-back has been shallow, dip buyers showed up yesterday right on cue. Soothing words from the Veep Vance was all it took and the TACO trade was back on. Today's earnings from the big banks were generally well recieved as strong capital markets eased the credit quality slippage concerns. No sign of recession, unless you are geared towards the lower-end consumer like restaurants and microbreweries.

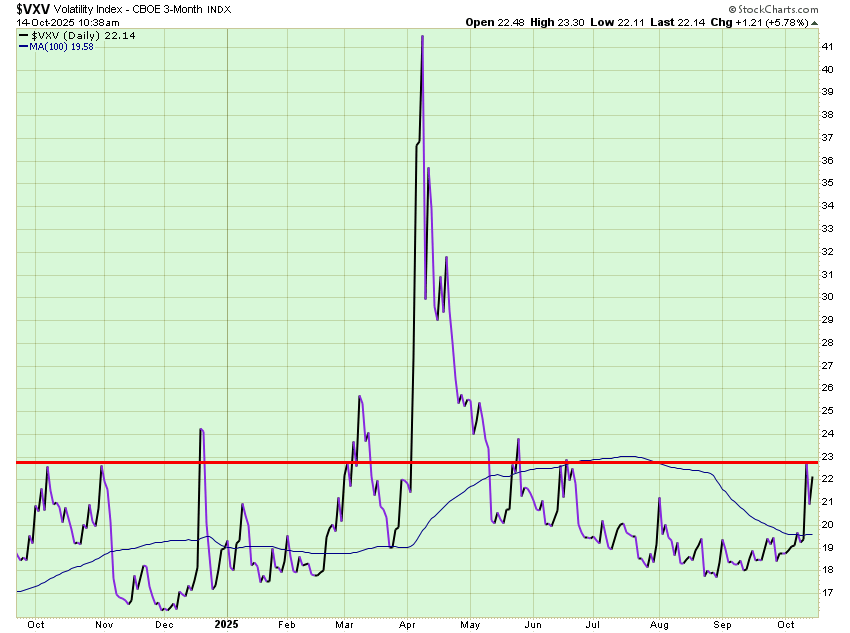

This shallow pullback may be all we get, given the easy financial conditions and shock-absorbing bond market action. I expected more, but the earnings reports from the AI players may be enough of a shiny coin trick for now and the government shutdown will eventually end. I had hoped for more, but the Model will kick in to 'buy' mode if the VXV drops this week.

3 Month VIX

Comments