Folding Chair

- Bob Decker

- Dec 2, 2025

- 4 min read

In my world, the second most important person in the United States government is not the Vice President, the Chief Justice of the Supreme Court or the Speaker of the House. - especially now that Trump has them all under his tiny thumb. The Chairman of the Federal Reserve matters more than those sycophants. As long as the global financial system is under the hegemony of the U.S. dollar, the Fed maintains its primacy in financial asset valuation and direction, full stop.

It's with a fair degree of trepidation that the financial markets await the impending appointment of a replacement for Fed Chairman Jerome Powell. Sir Mango of Mar-A-Lago has called a press conference for 2 PM. What could possibly go wrong?

Bond yields are suddenly jolting higher this week after having slid lower last month, spurred on by Fed easing hopes. The pattern now shaping up has a disconcerting look of a bottom (note the possible head-and-shoulders). While the economy founders amid consumer confidence and affordability challenges, there is no reason to think about a possible Fed pivot towards hawkishness. Nevertheless, I now have worries about the bond market. Indeed, the Administration's pick for the new Fed Head is likely to push for lower rates immediately if not sooner, so why are long yields suddenly rising?

10 Treasury Yield

Many a bond manager is getting increasingly skittish, judging by the recent halt to the fixed-income rally. So, why so glum chums? The economic news has been mostly bond-friendly as of late. Measures of U.S. economic performance are muted. From the readings in Manufacturers and Services Purchasing Managers surveys show no signs of overheating, with both readings hovering around 50%:

Manufacturing PMI

Services PMI

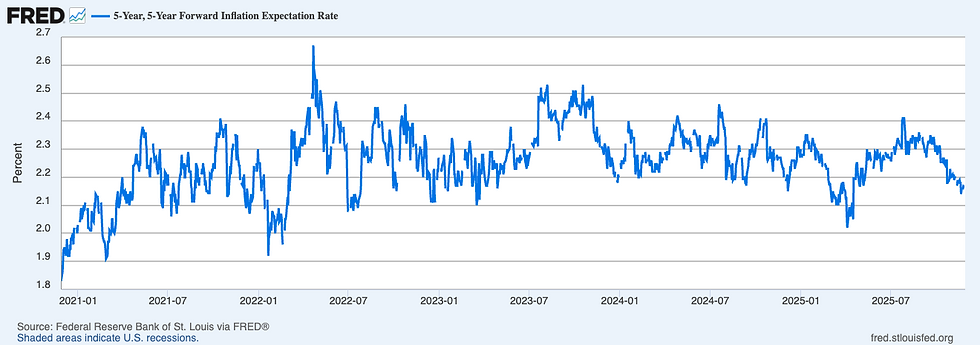

Inflation concerns have been justified due to supply shocks from tariff hikes. I consider these cost increases to be transitory (a word now banned from the Fed lexicon but nonetheless still valid ). Expectations as measured by the forward curve of the Treasury market have already dropped smartly since the summer. The markets have already moved on from that concern.

5yr-5yr Fwd Inflation Expectations

Could it be that the potential tariff tax receipt windfall is being reversed? A SCOTUS ruling on Trump's authority could be a valid concern. Revenue from increased customs receipts has already been pledged to bail out farmers, Argentina, and fund a $2,000 bribe to a pissed-off electorate, so no deficit relief is in sight. And any cogent analysis of the ratio of tariffs divided by tax cuts would have already led to the conclusion that the bond crop will never fail.

Another fly in the ointment is the sudden monetary come-to-Buddah moment in Japanese monetary policy. The Bank of Japan is now contemplating raising rates after years of artificial suppression. The competition is heating for the GOAT of fixed-income assets, once the exclusive domain of the almighty U.S. 10YR.

Japan 2-Year Yield

But all of this angst over the number one risk-free asset in the world is more noise than signal. The biggest asset the Federal Reserve has is not its holdings of financial assets or the prudential regulatory framework it presides over. It is the confidence in its independence from political moral suasion. If we get Trump calling the shots, that can now legitimately be called into question.

I don't know much about Kevin Hassett, the presumptive front-runner for the job. Still, I have to question the economic judgment of a guy who gleefully supports Trump's chaotic and arbitrary tariff regime being inflicted on an already weak economy. With a Federal budget deficit approaching that of a 2008 southern European basket case - aptly named PIGS - there is little wiggle room for a Fed that is seen as complicit. Should a policy of political accommodation to the populist cause of easy money become the norm at the Fed, watch out below - risk assets, I mean.

Markets will increasingly return to this theme from time to time over the next few months. Should there be a cyclical rebound in inflation arising from the twin stimuli of tax cuts and rate cuts in the early part of 2026, the bond blow-up could rattle markets at some point. A repeat of 1987's bond-induced crash is not out of the realm of possibility. How's that for clickbait? I really should have a YouTube channel.

The risks in bull markets often sneak up on you. A Federal Reserve that takes its cues from the White House is in plain sight now. The market won't take kindly to a Chair that folds.

Risk Model: 1/5 - Risk Off

The AAII Bull/Bear, Cu/Au, and 200 DMA signals remain negative despite last week's market recovery. The RSI isn't overbought anymore, so that is a positive. What is concerning is the VXV 3 Month Volatility measure - it is forming a dangerously shallow bottom that I would like to see negated.

Unlike a Venezuelan fishing boat, I hope the rally usually brought to us in Santa's sleigh doesn't get hit by a Hellfire missile.

3 Month Volatility Index

Comments