Naughty & Nice

- Dec 23, 2025

- 3 min read

It's time to reflect on an excellent year for stocks despite a bad year for almost everything else. If ever there was a year that defied prediction, it surely was 2025. If you had told someone every headline in advance, like a cowering Warren Buffett, you would have been a seller. You also would have missed out on one of the best stock market years in history.

But such is the nature of risk markets. They behave as they always have, on the anticipations of the crowd. Once the April lows were in place, those anticipations found their lowest point since the Covid-19 shock. What followed was something that markets often do best. They made most people wrong.

I feel a bit let down by my blog prediction performance this past year, despite the many prescient calls. After issuing a 'sell' in March and a 'buy' in April, I sat out the June - September AI mania rally. Taking the summer off was more of a lifestyle call than a bet on my part, but if you did as I said, you missed a hell of a rally. As a consolation prize, I did call the October correction and the subsequent 4th-quarter rally pretty well.

As for specific calls, I guess my preference for Boomer Bitcoin (aka Gold) over the digital variety, and the love-in with Copper as a hard-asset diversifier, has worked out well. Recommending a sell on Apple, on the other hand, was only temporarily successful. Avoiding the mega-bear stances espoused by some pundits also kept my short sales to an all-time low in my trading account. My best call of the year was to buy bank stocks despite the economic headwinds.

The next twelve months should continue to present investors with a chance to be wildly right or wrong. Stock selection will be especially tricky as the Fed's easing fades, with specific risks becoming a more dominant influence. But that is an opportunity for stock pickers to shine. Active management is my home team, and I will always root for them.

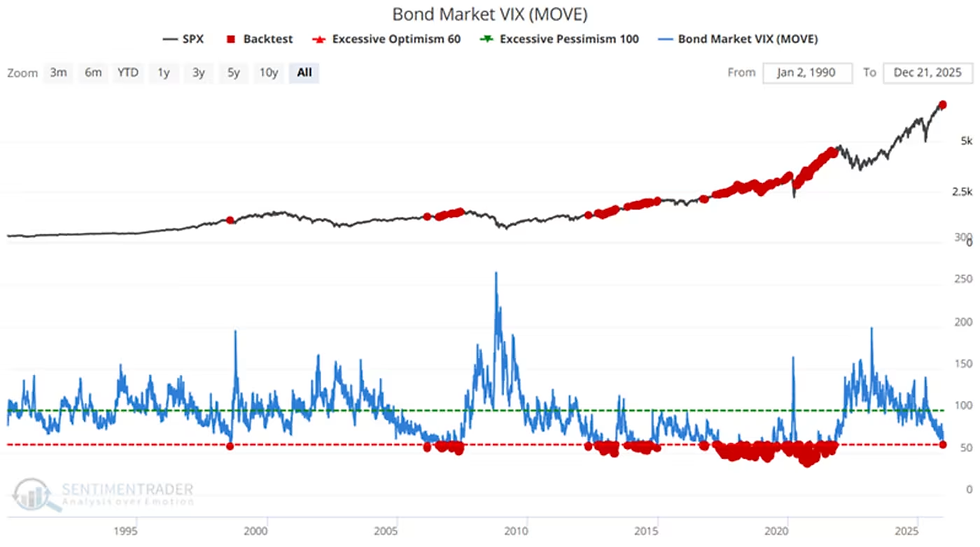

Recent fixed-income volatility has been muted, allowing the equity bull to march on unimpeded by any threat of sudden risk-premium expansion. Risk to the bond market from inflation is dying down, as the Fed has eased in response to the weakening employment threat. Absent any meddling in Federal Reserve independence from the administration, the 'boring' asset class should continue to live up to its name.

SPX 500 & Bond Market Volatility

Looking ahead, the stock market should broaden to include more economically sensitive stocks among the outperformers. I make this statement based on no current supportive evidence, but on a gut feel that the Federal Reserve easing often generates subsequent breadth expansions in the equity market. That is the identical call I made this time last year before Trump's tariff tantrum derailed the 2024 bottoming in the economy and drove investors into a crowded, narrow market dominated by a few mega-cap growth stocks. I expect that to change soon.

I know - broken clock theory alert!

RSP Equal Weight vs SPY

All in all, 2025 was an excellent year for risk-taking. A note of caution for you bears out there - never fight the Fed, no matter which direction they lean!

I must thank those of you who have followed my musings this year. The notes of appreciation I receive are most welcome, and there have been very few brickbats thrown my way despite the wrong calls. But I never confuse a bull market with brains. I try to offer some tidbits of knowledge gained through the school of hard knocks along the way. And as I always say, my blog is free, so you get what you pay for!

Risk Model: 2/5 - Risk Off

With an RSI nearing 70 and at 12% above the 200-day moving average, the TSX, at this elevated level, is not for the faint of heart. After a disappointingly shallow Fall correction, with the current Santa rally in full swing, the market is highly vulnerable to a sharp January pull-back. Investor sentiment has improved in a Pavlovian response to the rally. Protection trades are incredibly cheap here.

Copper is the talk of Wall Street after bullish comments from Citi, UBS and Goldman Sachs analysts. Small investors have chased the rally, and speculation has ramped up. U.S. tariff policy has created a short squeeze and engendered a hoarding mentality, exaggerating the fundamental rally. Stocks in the copper sector are stretched and have started to lose volume confirmation (HBM chart below). I'm taking some trading profits here. Bulls make money, Bears make money, Pigs get slaughtered.

HudBay Minerals

Comments