Dry Spell

- Bob Decker

- Aug 11, 2020

- 4 min read

The July-September dog days are often a soporific governor on investor motivations. This year, of record-breaking heat, is no different. A palpable sense of malaise has descended on the stock market, allowing for an extension of the sleepy, drifting rally. There seems to be no end in sight to the rise in asset prices whose sole motivation is FOMO and TINA. This rally is brought to you by your friends at the Federal Reserve and rest of the global Central Bankers, hosting a beach party featuring monetary jello shots.

Yesterday, Russia's vaccine news was driving the narrative. Putin's defacto enrolment of 145 million people in what is, effectively, a mass Covid-19 phase 3 trial, spurred the bounce in economically sensitive assets. He even admitted his daughter has been inoculated. Quote The Champ - "I sez pardon?".

Yesterday saw a mini-rotation away from last week's winners - bonds, gold and growth stocks. Value stocks, Financials, Energy and early credit cyclicals benefitted. Classic reflation action.

But, really, is it that easy? You can accuse Mr. Putin of 'jumping the needle' with Russia's claim of an effective vaccine, but there is no denying the positive effect on investor expectations. With the arrival of a proven, effective vaccine, the narrative will change, and with it, market leadership.

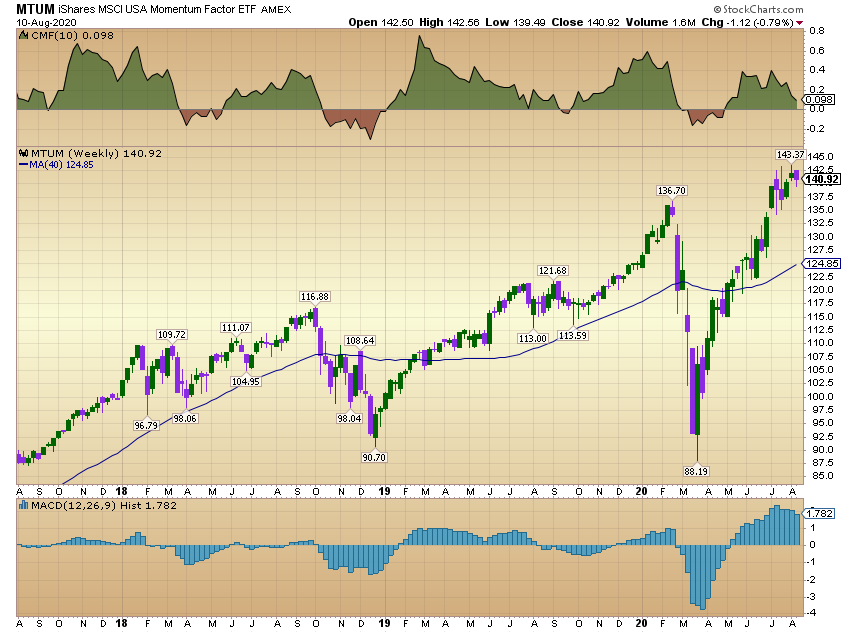

The 'NASDAQ era' of market dominance is now looking a bit suspect. The attribute of perceived 'Covid immunity' that has shielded the mega-cap growth companies from the economic sudden-stop is now looking less desirable. The chart has rolled over. They are looking tired and expensive. As I recently pointed out the Chaikin Money Flow (top panel) and MACD measures (bottom panel) did not confirm the recent new highs set by the 'winning' trade of MTUM, the momentum based ETF.

MTUM - iShares Momentum Factor ETF

So does that mean I'm running out to buy the bombed-out value trade?

Not so fast ex-Leaf fans. (I know you're out there).

Although the preconditions for a successful reflation have been met - ample credit with a firm backstop from the Fed - the normal economic recovery is unlikely to take hold so easily. A 'W' pattern of recovery is still possible in the U.S., given the structural nature of economic disparities extant. One only has to see the news from Chicago and elsewhere for this to become obvious. Now that the initial stimulus has been spent, the looting has begun. A fumbling President and dysfunctional Congress is likely to provide a replacement plan that is too little and too late. If the market continues to buy into this narrative, it could be a huge 'sell-on-news' event when it arrives - if at all.

And multiple economic uncertainties can only increase as we approach yet another divisive U.S. election. Trade, taxation and States' finances are likely culprits. A witches brew of negatives will likely result in downward revisions to earnings and growth expectations for Q4.

That does not mean the stock market is doomed. The easy monetary conditions and high equity risk premium has seen to that. I'm just arguing for caution in front of a possible chaotic correction - one likely to present better buying opportunities. There is a very strong history of leadership change being correlating with market corrections. I'm just respecting history when I say this.

The rally in bonds and gold are really expressions of the same thing - 'I'm worried about things getting worse'. We are seeing both assets get simultaneously smoked this morning - ultimately a good sign. But I can't shake the feeling that they both have been sending negative messages about the economic path to normality. Covid related demand destruction is not just like having a bad credit score. Normal consumption patterns have been damaged beyond their historical norms. Some permanently.

The recovery from this economic slowdown will be sub-par and fraught with setbacks. A wave of post-stimulus bankruptcies is just one example. Once the fiscal largess from government is reduced or removed, the soft underbelly of the economy will be exposed and weak companies, previously sheltered from risk, will be vulnerable. Think about that when going 'all-in' on this bank stock rally.

So we have a mean-reversion week on our hands. But it's hard to gauge the durability of this market rotation. We will need to have a massive roll-out of vaccination programs in order to have full confidence that the feeble 'virus economy' has been rejuvenated. Jingoistic pronouncements based on unproven science from Vladimir Putin aside, we are a long way from that day.

I'm probably underestimating the optimists here by warning of falling skies like some grumpy, retired version of Chicken Little. Don't forget how much cash is sitting on the sidelines earning zero! But during the sleepy, low-vol summer months, it's hard to get excited about anything other than taking a dip in the lake. I'm still sitting this one out for now - on a beach chair.

Risk Model: 2/5 - Risk Off

With the recent ascent on new highs, the RSI component of the model has kicked in with a sell signal. Remember, it's XIU based so I guess the rotation trade to cyclicals and energy was what was needed. Meanwhile the NASDAQ RSI and 200 DMA rules have been screaming 'sell' for weeks.

The Copper/Gold ratio collapse (below) is interesting given the depth of the recent pullback. It can restore a buy signal only if Gold falls significantly more that today and Copper regains $3 or better. We have a long way to go to the 50 DMA.

Copper markets have shown signs of excess speculative activity in the recent COT report. In a non-confirmation of the nascent rotation trade, they aren't rallying today either.

Copper/Gold Ratio

Comments