Crossing the Line

- Bob Decker

- May 27, 2020

- 4 min read

The unbridled optimism of Americans, combined with their dismissive reaction to anything that smacks of an attack on their freedoms, was in full view this week. After opening up the bars and public spaces, a literal tsunami of hedonism was unleashed - witness the above photo taken at the incongruently named "Lake of the Ozarks" party pool bar. Life, liberty and the pursuit of happiness indeed!

Many commentators said they 'crossed the line' by aggressively gathering in such close proximity. It did look like a human version of a lab-rat maze. A highly appropriate metaphor considering that densely packed gatherings are likely to accelerate the 'second wave' effects of the Covid pandemic. We will soon start seeing 'W' shaped data on rebounding Coronavirus incidence rates. But in the near term, jump in, the water's fine!

A line once crossed, will be hard to retrace. State governors, calling for restraint and social distancing, are literally being drowned out. Pandemic 'deniers' are in the ascendancy, offering up all sorts of conspiracy theories and unscientific babblings on the internet. I'll even bet that Hydroxychloroquine highballs were being served.

The markets have similarly arrived at a series of significant lines themselves. Holding them back, as the dwindling number of bears have bet on, seems increasingly problematic. Rational humans in this strange world are a dying species. Remember short sellers, markets can stay irrational longer than you can stay solvent!

When you are getting paid to not work and government policy has outlawed risk, this is what you get. A free pass from financial hardship has been issued. Markets have now thrown in the towel in the fight against the Fed.

Investors are getting increasingly infatuated with vaccine announcements. Last week, it was Moderna, with its teasing, optimistic news release that touted its candidate. Today, its Novavax, the Bill Gates-backed biotech firm, announcing new trials of an unproven drug therapy. Like I said last week, it's like a gold company saying it's gonna drill a hole. But when the stock promoter is the same guy who built Microsoft, you better get on board the hype train.

Most cautious investors have been waiting for more evidence before getting active in the markets. They raised a whack of cash, bought bonds/gold/crypto, and are sitting back waiting for the 'bad' news to roll in before buying stocks. Now that the news is in, they are confused by the market's ability to shrug it off. But we have seen this before.

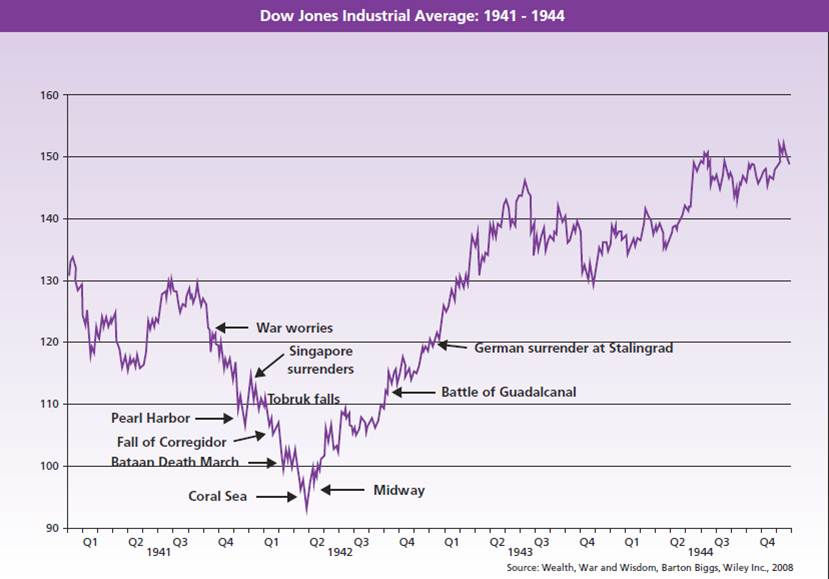

In my blog dated April 7th I put in a chart that even I had trouble believing. The market bottomed 3 years before 'VJ Day". But this time, the 'Battle of Midway' victory is in the form of the Fed's propping up of the credit markets in late March. A $7tn aircraft carrier is a formidable opponent.

And remember the importance of the second derivative effect. The 'war' on Coronavirus is far from over, but crossing over the line from 'bad' to 'less bad' creates a positive backdrop and improved risk expectations. Markets are now thinking that this war is 'winable'. And, as I always argue, it's expectations that matter.

Speaking of lines, the Risk Model charts are now in the process of crossing into 'risk on' territory. The long awaited rotation trade is here. Now it's time for the 'catch-up' phase of the rally where the relative value, long-short trade works best. More on that below.

Let's not confuse this with investing - it's trading only.

The repercussions of the sudden economic sudden stop on globalization, efficiency and productivity from the post-Covid world will be very damaging to both growth and productivity. Debt overhangs will suck up excess free cash flow for years to come, impairing productive re-investment. Wealth and capital gains taxes will expand. A pre-election correction in the U.S. market, based on a polarized and uncertain electorate is likely.

But if somebody draws a line, and you cross it - be careful of what you get. A corrective pull-back will come from the same source as the catalyst for the rally. Fed policy change. At some point, when the economy gets its feet under it and the Fed feels comfortable enough to take the training wheels off - watch out. A 'taper tantrum' 2.0 is somewhere ahead of us.

But today its getting hot. Back in the pool.

Risk Model : 4/5 - Risk On

The trade I have been waiting for is here. The 'low quality' catch up rally is on! Banks are the low hanging fruit of this market. The cautious cash rich 'home gamers' that bought HYG and LQD are now going to chase the XLF. As I have been arguing, you were paid to wait and now that the bad earnings and successful stress tests are seemingly 'priced in', they are ready to take off. How high can they go? Short answer is I don't know. But at least they will continue to pay their dividends and that may be enough for now.

As I have maintained for weeks, the model will lag the 'market' due to the trifurcated nature of the index - remember it a "LUV" market. It was never designed to catch the growth stock mania. This rally reflects a dangerously late stage profit opportunity. But it's a necessary precondition for achieving an intermediate peak, prior to a corrective phase. It's time for 'Value' to get some love.

Crossing The Lines

3Mo VIX

- crossed this morning

Copper/Gold

- crossed last week

AAII Sentiment

- likely to cross, given today's positive sentiment

Comments