Battle of Midway

- Bob Decker

- Apr 7, 2020

- 3 min read

It was June of 1942. The U.S. Fleet scored a decisive victory over the Japanese Imperial Navy in the South Pacific. It was a turning point.

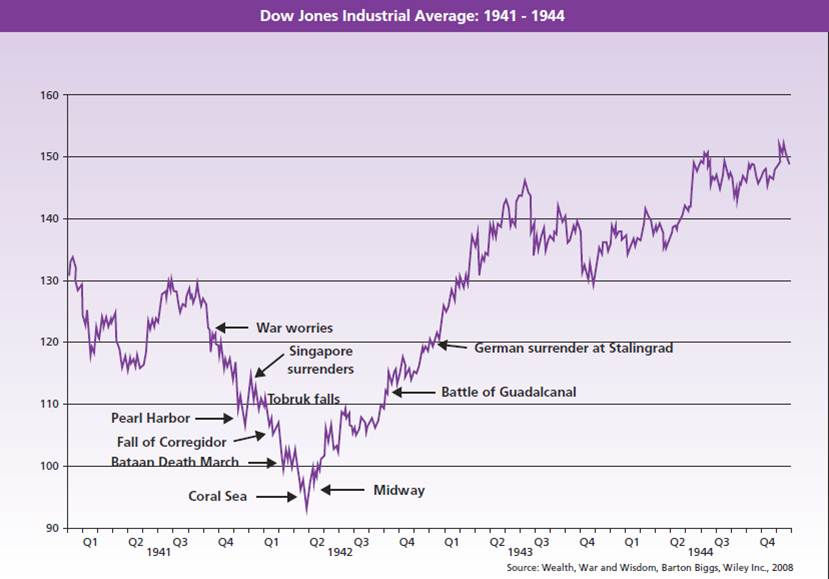

Most historians agree that the battle of Midway, a previously unimportant spot in the south pacific sea, marked two very important milestones. American forces obtained dominance over the Japanese fleet thus turn the tide of the war, and the U.S. stock market bottomed.

What is interesting about the latter event is that it occurred so far in advance of the war's end. It was only six months after the sneak attack on Pearl Harbor. The war would last for three more years, finally ending in August of 1945. There were many setbacks along the way to that ultimate victory.

But the stock market never looked back.

The markets of 1942 proved that optimism about the future could offset any amount of bad news you could throw at them. It's sort of a reverse Yogi Berra: "If people want to buy - you can't stop em."

I present this only to prove a point about expectations. In the markets, expectations are all that matter. Even if they are too early, too optimistic or dead wrong. They still drive markets and no amount of naysayers can stop them.

Me included. So much for patience.

We are now witnessing a face-ripping 'flattening of the curve' rally - one that has also flattened the bears. Optimism is growing that the dreaded Coronavirus will soon be defeated. And markets have responded quickly.

Is this a head-fake? Do I still think a re-test is ahead of us? Is Tony Dwyer flogging a dead horse?

Call it short-covering if you like. There is no way to know for sure. Remember, FOMO and TINA? They still have scores of adherents.

Today will be an important test. The market should run out of steam after sober second thoughts about the rally start surfacing. Tuesday @ 11 looms large.

Currently, all risk markets are trending in a similar fashion. The VIX is declining, the U.S. dollar is weakening, the yield on 10yr Treasuries is rising. Even Citigroup is up. I can't see anything wrong with this rally. But sometimes you never do.

At what point do we get nervous? That point, in my view, is likely around S&P 2800, coincidentally my estimate of long term fair value that I presented last week. Above that, is a risky zone.

Hmmm ... a 50% retracement level. Mid-way. Should be quite a battle.

S&P 500

We shall see if the lows are in. They never ring a bell at the bottom.

Risk Model: 2/5 - Risk Off

Not knowing what people are thinking is pretty frustrating in such a fast moving market. The model could actually go into risk-on mode if the AAII sentiment numbers bounce hard this week. Unfortunately we won't know until Thursday when the data are released.

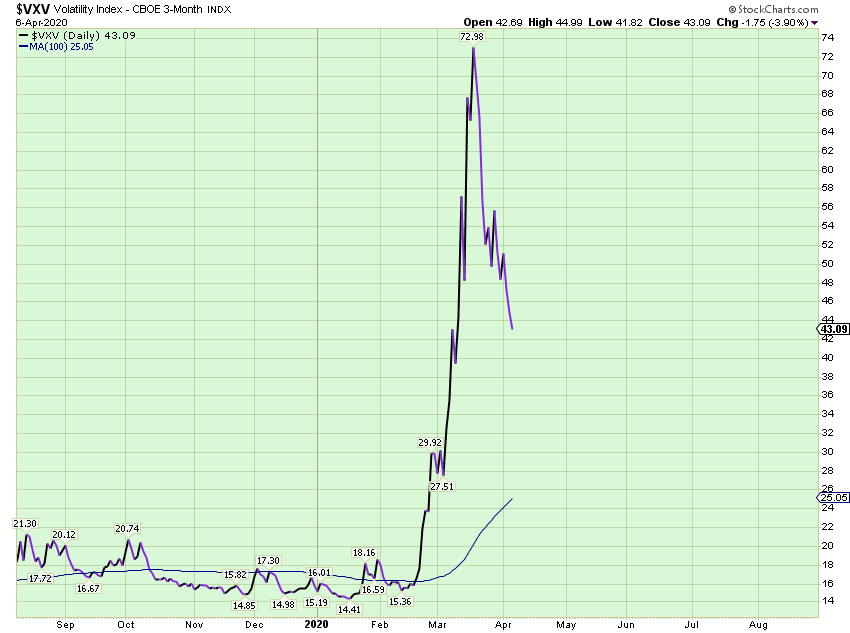

The declining 3 Month VIX has a bit more to go to generate a buy signal. This was the case during the 2008-09 phase as the market waited for 4 months from the VIX peak before registering its final low in March.

3Mo VIX : 2008-09

I believe with the current set-up, we will need more time to cross the signal line (100 dma) to be certain that we have seen a durable bottom.

3Mo VIX : 2020

Comments