Naughty & Nice 2

- Bob Decker

- Dec 18, 2018

- 5 min read

Just like one of those endlessly bad movie franchises (what are we at now, Rambo 7?) I'm gonna produce a repeat performance of last year's "Tues@11 Naughty and Nice List".

There's no sense spouting off all year without being held to account at least once. Here goes:

To say that this year has been tough is like saying Justin Trudeau likes selfies. Pretty obvious, but it still needs to be said.

This was a year were there was nowhere to hide except cash. The persistent removal of monetary stimulus by the FED created a harsh set of financial conditions that stressed all risk assets. Real Estate, Junk Bonds, IPO's, and Commodities all suffered equally, along with the soggy equity markets. As usual, the riskiest suffered the most. Just ask those poor suckers who drank the Bitcoin Kool-Aid last year.

This reminds me of a favourite saying - "Asset prices are always, and everywhere a monetary phenomenon". So, in January, when I started to obsess about the risks to the market from the FED's policy of interest rate 'normalization', it was with good reason.

Early in January, I worried about the relative valuation of stocks and bonds after the 'blow-off' rally. The melt-up precipitated by Trump's late 2017 tax give-away, when contrasted with a period of steady FED rate hikes, created an unsustainable situation that I likened to 1987. As 'crowded short' positions in volatility quickly unwound causing a sharp correction, I started to believe we could see the beginnings of a major market top forming.

By April, although the market had resumed its rise, my thoughts turned to the waning fundamentals of the credit cycle, as autos and housing had demonstrably peaked.

By July, when it was obvious markets were unable to broaden out, I was out of the market entirely, seeing the deterioration in volume and breadth as a precursor to trouble. The FANG trade was becoming dangerously inflated in my view. The 'tell' here was the weakening performance of both the foreign markets and the U.S. banking sector. The low volatility readings last August were a red flag that I likened to the "calm before the storm".

I identified the three most crowded trades, long Euro, long Oil and short Treasuries, and argued to the contrary in each case. My oil call was bang on. I simply used my knowledge gained as an oil analyst during the 1986 OPEC collapse. As for bonds, the (Fine Line - Oct 23) for me was a chance to go long the 10 yr at 3.25% as the shorts started to cover. I made money last month!

In September I had written; "now the worst seasonality for volatility looms ahead", concluding; "what part of 'sell' don't you understand?"

That call coincided with the peak in both valuations and growth, it has been downward ever since. So, all in all, not a bad year for your humble blogger.

And last week, I counselled caution, as my risk model had tripped into 'sell' mode in October, and was unlikely to regain its footing without a dovish message from the FED and a re-accelerating global growth picture.

And I'm still waiting for the political shenanigans to subside. Hey, let's shut down government for Christmas everybody! Don't worry, it's only a lump of clean coal from the Trump administration in everybody's stocking.

All in all, I am pleased with the 'Nice' stuff - but what about the 'Naughty'. You know, the stuff that keeps me somewhat humble.

My shorts on ENB, QSR and RCI haven't played out too well. They have held in stubbornly well, as, in Canada, banks and resources took the brunt of the selling. I guess when it comes to the Canadian market, there aren't many options. As my friend Colin Gibson liked to say, "in the land of the blind, the one-eyed man is king".

I also admit my Q1 call for an inflation problem was, in hindsight, premature. No harm, no foul though, as by June I had given up on the hard asset trade. I haven't owned an oil stock in more than six months now. The summer rally in metals I forecast this year was pathetic. My hoped-for gold rally in September was tepid and short-lived.

So what looms ahead for risk takers? (that's assuming such an increasingly scarce species still exists).

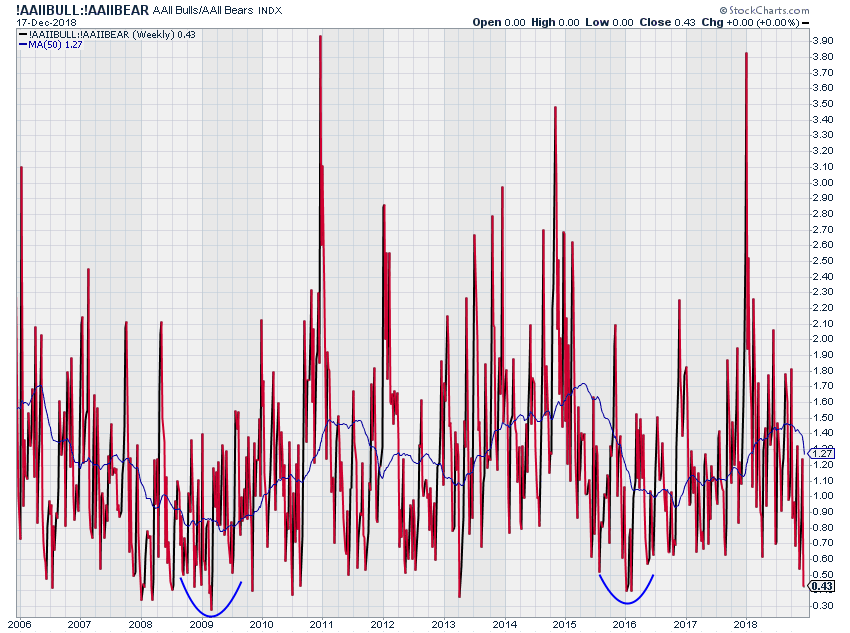

Well, the contrarian in me is getting interested after last week's eye-popping numbers on AAII Bullish/Bearish expectations were released.

As pointed out to me by Joe Luca (ex-BMO position trader to the stars) the outsized decline was notable. (see Chart). We are now at the low readings seen during the 2009 and 2016 market bottoms. Contrarians, get out the blue tickets.

AAII BULL/BEAR Ratio 2008 - 2018

As well, the 'get-me-out' crowd was in full force last week, judging from the hugely negative readings in the fund flow data. Record redemptions from stock funds is always a sure sign of an approaching bottom. So now that we are seeing towels being 'thrown in' and capitulation sentiment readings have been met, what else will we need to see to mark the bottom in stocks?

Again, remember that stocks are a monetary phenomenon. I still think we need a 'dovish' hike on Wednesday from the FED! The market wants the FED to back off, either on the number of hikes or on reversing the balance sheet unwind - or both.

The trouble is - so does Peter Naravro, Steve Mnuchin, Larry Kudlow, Jim Cramer, the Wall Street Journal and, most importantly, 'The Donald" himself. His last-ditch twitter campaign this week to forestall a well-telegraphed rate hike scheduled for tomorrow has placed the FOMC in a no-win situation. If they hike, they're the enemy of the people - if the don't, they are emasculated Trump sycophants.

After everything that Trump has done to shoot himself in the foot on trade, you would think he wouldn't dare mess with the FED decision making process. But you'd be wrong. He's already taking resumes for Powell's successor.

And I really can't believe Jerome Powell, you know, the guy who painted himself into a corner, (the one that was "far from normal"), is gonna look himself in the mirror on Wednesday morning and say "President Blowhard is right!" and stop the rate hikes.

I think I'll just keep my head down til this shit-storm blows through. If I miss the bottom by a week, so what. I guess its just my way of being both naughty and nice.

Risk Model: 0/5 - Risk Off!

As you can imagine, any quant model worth its salt would be in a negative signal position right now. With the re-upped VXV readings and shocking drop in the AAII sentiment, the model is firmly in the red. Notably, the 200 dma rule (now 7% below) kicked in, as 'get me out' sellers of the TSX competed with tax loss sellers for an ever dwindling number of bids.

Looking ahead, I believe the market is currently seeing economic disaster where none exists. This morning, the housing start data is shown a successful bounce from the weather related weakness in October. The Atlanta FED GDPNow estimates have bounced back to 3% (see below).

The case for a 2019 soft landing is still alive and kicking. The pain trade for next year may be long vol yet again. The momentum based algo sellers are ruling the roost currently. They will run out of bullets sometime. We just need this year to be over!

Comments