Do the Tighten Up

- Bob Decker

- Oct 16, 2018

- 5 min read

This morning, the speed bump correction looks to be virtually over almost before it began. Markets are stabilizing (on a Tuesday I might add) around positive responses to the Morgan Stanley earnings. It isn't the specifics of Morgan Stanley that are important, although yesterday's dry heave moves in Bank of America and JP Morgan had me wondering about the banks. They are everyone's consensus pick to beat the spread for the next phase of the financial football game.

As Jack Nicholson might say "you need them on that wall."

So we need the banks to act well to really find a tradable low. The earnings this week are really just an excuse to bottom fish the oversold conditions. But its a start. Greed is slowly overcoming fear. The Vix is calming down nicely.

When the Fed gets to where they are going, the next phase of the market can truly begin. But are we there yet? If you have listened to Jim Cramer who is now echoing his famous "they know nothing" rant, you would think that the market correction can solely be ascribed to a doctrinaire FED who are blindly leading us on the path to destruction. By extrapolating the weakness in housing and auto into a "beginning of the end" commentary, he has turned a garden variety and long overdue correction into the second coming of 2009.

Only in this way, can he fan the bullish flames of American hubris and defend his tiresome thesis of 'Make American Stocks Great Again'. I, for one, am getting pretty sick of the concept of American financial exceptionalism. Take a pill.

But is the even FED close to the pain threshold? But where are we in the tightening cycle? Are we anywhere close to the point at which financial conditions cause a recession?

In my view we are as close as Leafs are to clinching a playoff spot. We are heading in the right direction, but the season is long.

To see where we are going, one has to look at where we are coming from. The Great Financial Crisis of 2009 generated a level on monetary ease that had never been seen, let alone contemplated since the FED was created in 1913. That alone means the cycle will take longer to play out than anyone can imagine. Investors (and I blame myself somewhat) have been fixated on timing the end of the cycle. Its a mug's game.

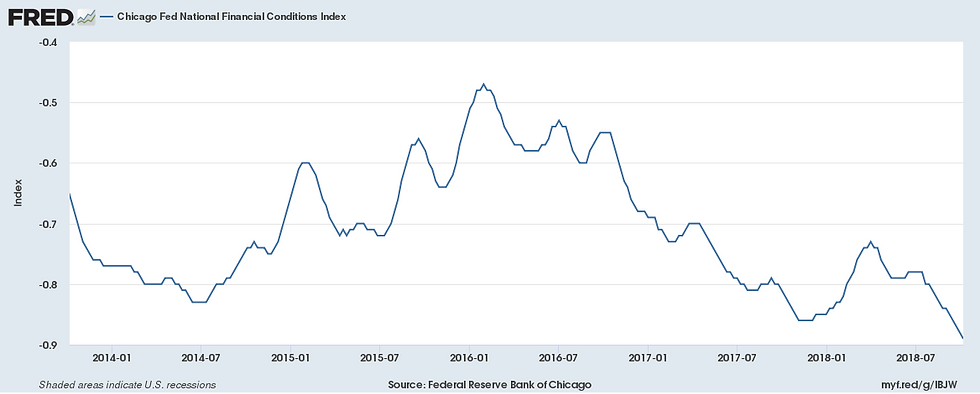

Financial condition are still VERY loose, as shown in the following FED graph. The lower the line, the 'easier' monetary conditions are. This index incorporates, credit conditions from a broad array of indicators. It is not signalling any stress to the real economy. This means there is still time to play the long side, especially if they take their foot off the monetary brakes temporarily.

CHICAGO FED FINANCIAL CONDITIONS INDEX

I admit to having been obsessed with the "inverted curve" for over a year now. With a rise in 10 year bond yields over the last few weeks, the goal posts of that game have been moved. The curve has actually steepened since August. This demonstrates the fallacy of timing the cycle's end.

And more good news. With stocks on the defensive, the FED is more likely to pause at some point. The most recent retail sales and inflation data are supportive of this. By December, the deceleration of the economy that has been created by the tariff wars should be more apparent. Walmart is going to struggle to pass through the cost increases from the tariffs. Estimates for 2019 earnings need to come down. The second derivative of profit growth is now negative. That will provide cover for Chairman Powell, a self-described data dependant guy, to move his rate hike forecast downward.

So the correction that will play out over the next few weeks is a time to reassemble a long only portfolio for the next run. The move to deeper cyclical exposure will take more time as the Chinese deceleration that is affecting emerging markets needs to show evidence of turning around. Oh yah, there is Brexit, that mess in Italy and the U.S. mid terms to deal with too. So don't chase the first bounce here, but the next big move now looks to be higher. Buy the dips.

The correction we seeing is a valuation re-set due to higher yields, similar to the 1987 crash - only a far milder version so far.

I've seen this movie before.

It should set up a pause on the part of the 'tighten up' FED.

OIL

The murder of Jamal Khashoggi last week has failed to send oil prices higher. Initial reports looked dire as a thinly veiled threat from a government controlled news site, Arabiya, (think: FOX NEWS of Saudi Arabia) threatened to weaponize the oil price should the U.S. sanction the Saudis. For their part, the House of Saud, desperate to deflect criticism, are effectively using the time honoured 'dog ate my homework' excuse, saying "rogue elements in an interrogation gone wrong" were to blame.

Nobody actually believes the Kingdom, with its long history of using internecine murder as a succession planning tool. The existing ruling family came to power by bumping off cousins and brothers. So if a pesky journalist is murdered on orders of a paranoid monarch who's gonna notice? An unfortunate miscalculation indeed.

But oil could actually come under downward pressure should the Saudis relent on their threat. Is a quid pro quo deal in the works today, with Pompao's visit? Cheap oil in exchange for U.S. complicity?

I repeat, there is plenty of $70 oil to go around. Watch yourself on your oil exposure. The seasonality for the commodity is now negative. Next month's Iranian sanctions may turn out to be a classic sell on news.

Oh that reminds me, with tomorrow's pot legalization looming, can anyone tell me where to get the borrow on Tilray?

RISK MODEL: 1/5 - Risk Off

The model, having been late to catch the correction is likely now late to catch the bounce. AAII Sentiment is now acting like a one week lagged VIX, as market conditions change daily. I'm taking my sentiment more from my gut feel now and it served me well last week. My gut is now saying "Buy".

More importantly, Copper/Gold has pulled back to the summer breakout line. If this holds and pro-cyclical inter-market action improves, we could be off to the races for the next phase of economic expansion. Last week's LME Metals Conference was consensus bullish. The slowdown in global financial markets is not bleeding into the real economy. This is also similar to 1987, a good sign for a resumption of the cycle. I'm hopefully watching Dr. Copper closer than ever!

Comments