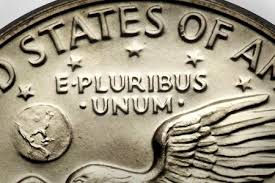

E Hubris Unum

- Bob Decker

- Sep 18, 2018

- 4 min read

The U.S. national motto reads - E pluribus unum - "Out of many, one". But when 'the many' are acting with a level of superiority and conceit - hubris - its time to call them out.

The accepted market narrative this year has revolved around the impervious nature of this bull and the success of the MAGA-driven policymaking that has propelled it. Trump's increasingly dangerous tariff proclamations are seen as "art of the deal" posturing, cleverly designed to cower his opponents, foes and former allies alike, into submission.

Last night's tariff announcement, effectively a double-down bet on forcing China to the trade table, is a serious miscalculation. Like a gambler who has a large stack in front of him, President Cheeto couldn't help himself from going all-in.

Egged on by his China-bashing Svengali, Peter Navarro, Trump has shot the wad on this latest salvo in his trade barrage. By adding a 15% year-end kicker to the widely expected 10% rate on $200BN of goods, he is splitting his aces, like a gambler on a roll.

Much to the chagrin of many S&P 500 CEOs, this threatens to push the issue of trade onto the front burner. A growing plurality of business leaders are vainly warning of the negative second-generation effects of tariffs on consumer confidence and spending. By effectively jacking up Walmart's cost of goods sold with these tariffs, this latest move is doomed to backfire on the economically inept Tweet House. Christmas spending could suffer and inflation measures will step function higher.

Meanwhile, Trump's xenophobic cheerleaders continue waving their pom-poms from the sidelines with every new tariff announcement. Witness last night's embarrassment from Jim Cramer, who last night defined the tariff war as a victory for the U.S. simply because the Shanghai market is down year to date. Trade war is a zero sum game and Cramer should know it. Talk about drinking the POTUS Kool Aid.

Market reaction has so far been benign, reflecting a sense of 'it could have been worse'. I not sure how long this can last, it I don't agree with the don't worry, be happy crowd.

For the true Trump believers, the ends justify the means. The short term pain of cost increases on imported goods is worth it if it helps address the trade deficit and IP thievery issues. They have blithely dismissed the Trump tariffs as negotiating tactics. That line of reasoning looks increasingly like wishful thinking. And its a strategy can only work in the long run. The pain will be felt now.

But the Trumpians are seriously delusional (of course they are - they did vote for him) if they think China, ruled by a 'Premier for Life' is about to cave into a guy who is about to lose control of the House and will spend the next two years trying to stay out of court. Xi knows an empty threat from a vacuous wind bag when he sees one. China plays the long game VERY well.

I do have some sympathy for the line of reasoning from the trade hawks. Current U.S./China trade policy was developed when it was an agrarian hermit kingdom in need of a hand up from mass poverty following years of hard line Communism. Henry Kissinger, Nixon's, Foreign Secretary, gave away the farm with his deal making in the early '70s.

Modern China, now an economic superpower, necessitates a revamped framework. Unfortunately, Trump doesn't know how to create a win/win compromised solution

working with his flawed grasp of economics and simplistically blinkered world view.

My bet is still on the short side. The market is lurching towards an increasingly uncertain 2019. Year-over-year comps will be virtually impossible beat let alone raise. We are in peak earnings growth territory and economic surprises are now starting to become more negative.

There has been a herd mentality towards Growth/Momentum as a factor for far too long. The number of volume non-confirmations in growth stocks is now widespread. The RSI non-cons are now multiplying. Apple is a perfect example:

Apple- MACD, Money Flow and Price

The MACD and Money flow variables did not make new highs with the stock, indication of a weakening tape. There are many examples of this set-up in Growth land.

But I now believe an orderly rotation to Value is impossible without first having a correction. That correction is increasingly likely given the knock-on effects on global growth and consumer confidence from the all-out China trade war we are witnessing.

Don't forget, the yield curve squeeze play is still on, as the 10YR bond prices are being held up by the risk-off bid, while FED Chair Powell continues to jack short rates. The curve will continue to flatten. Its no wonder banks can't catch a bid.

As to hard assets, Gold is acting better since the currency markets have stopped their Dollar love-in. I think the currency guys are right to cover their non-dollar shorts. The minute the Fed blinks by messaging a pause, I think gold pops $150.

The pain trade is now long Growth/Momentum.

Rotation is closer than ever.

But the Hubris has to die down first.

Risk Model: 2/5 - Risk Off

As predicted here last week, the AAII Bull/Bear ratio plunged downward with the spike in VIX early last week. Investors seem to have a hair trigger to the ebb a flow of trade news.

Volatility measures came off late in the week on hopes for China trade talks. Yesterday's surge briefly put the indicator into sell mode. It has reversed today after cooler heads started to prevail. I use a three month VXV measure but even that time frame is whipping around violently.

Copper/Gold continues to suffer from global growth slowdown fears, and the RSI is weak. Copper itself has held the recent lows, offering some glimmer of hope for the bulls.

Comments