The New New Normal

- Bob Decker

- Jul 17, 2018

- 3 min read

The job of the Fed - to return monetary policy to normal - just got harder.

As the Q2 earnings parade rolls out and strong second quarter data are revealed, stocks are trying shrug off their first half malaise. Paralyzed by Trump's trade sideshow, investors have largely ignored the fundamentals in a consistent bout of risk-off behaviour. Blackrock has just reported net outflows on stock ETFs for Q2, and more surprisingly, inflows into bonds. The AAII survey recently spiked to a two year low for Bulls vs Bears.

As Yogi said, "If people don't wanna come to the ballpark, you can't stop them". (You just can't get enough Yogi!)

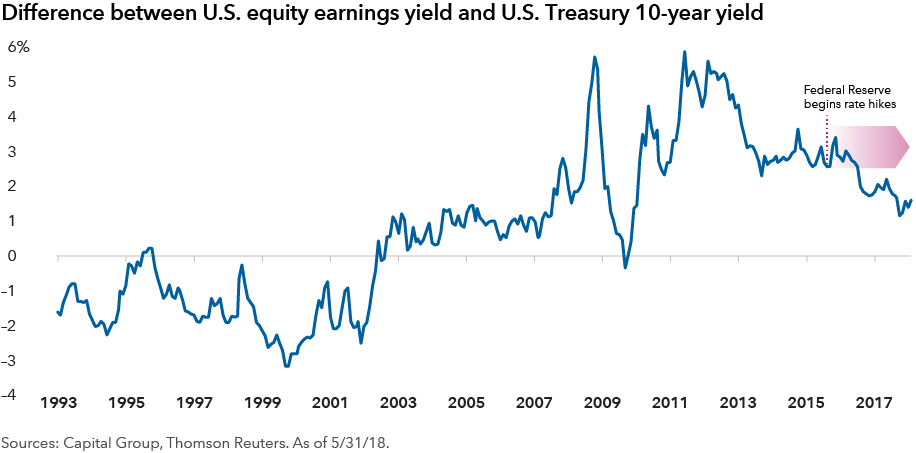

The case for equities remains relatively compelling from a risk premium standpoint, as the chart below shows.

Although narrowing significantly since the Fed began to raise rates, there is still a valuation advantage to equities, especially given the strong earnings performance of the past six months.

One can also see how cheap stocks were to bonds at the 2012 lows. The bull market in pessimism that spawned those generationally cheap valuations is slowly dissipating but not completely gone.

Also holding back equity risk-taking seems to be the aggressive Fed policy of normalization. The potential for a cycle ending policy error has been heightened by a Chairman Powell's slavish adherence to data dependancy. And the data are good.

The Fed rate hikes have continued, despite the trade war headline risk. Chair Powell is faced with the unenviable task of unwinding the largess heaped on the economy since 2009. For Powell, juggling an over-stimulated hot economy with a trade war brewing won't be as easy as pouring gasoline on the 2012 economic fire was for Bernanke.

And good luck managing the short end when the long end doesn't want to cooperate. Ten year yields should have been 3.5% by now, if not for Trump's meddling. The economic effects of tariffs may not seem like much, but the 25 basis point 2s - 10s yield spread says different.

Fed doves, notably Kashkari and Bullard, have been warning about the premature inversion of the yield curve recently. They are right to point out the anomalous behaviour of longer term yields during the so-called 'late' stage of the cycle. The depressing effects of technology and globalization on inflation expectations are well known to the Fed. Inflation is stubbornly low and the Fed knows it.

As well, I believe the risk pessimism that has permeated financial markets since the Great Recession is still with us. A strong dollar, combined with unattractive alternatives globally are driving investment flows into the longer end of the bond market. All this despite the record issuance emanating from the Treasury.

Surprisingly this late into the cycle, inflation expectations are moribund. The Five Year-Five Year Forward chart of inflation expectations clearly shows a significant decline recently. This means that two year yields are now positive in 'real' terms for the first time since the '08 crisis.

Inflation Expectations - 5Y/ 5Y Fwd

If the bond market can't sell off, raising yields over the next year, it says much about the psychological effect Trump's economic policies are having on risk appetite.

So be careful Mr Powell, the normalization you are seeking is closer at hand than you may want to believe.

Risk Model: 2/5 - Risk Off

The slight over-bought RSI is correcting quickly, thus giving a chance for a risk-on signal this week. The bounce in sentiment from the huge decline two weeks ago, shows investors are slowly regaining their footing after the trade war rhetorical peak.

The biggest fly in the ointment is the Copper/Gold ratio, now sitting at a six week low. Should it rally on any positive Fed or Trump related news, the summer rally that often follows a June low in metals should be a good trade, but only a trade. Seasonality for base metals is now positive. A September rally time-frame is also shaping up for Gold.

Comments