Cell Signal

- Bob Decker

- Jan 16, 2018

- 5 min read

On a recent trip to the local mall, not to shop, but just to get out of the house (really Deck, mall walking?), my wife and I both noticed a somewhat peculiar fact about Oakville Place. There are twelve separate places one can purchase a cell phone. Twelve! There aren't more than fifty stores in the whole place. The biggest one, Sears, just closed, and I half expect it to be repurposed as a giant mobile phone kiosk once they clean the place up a bit. Since this mall is relatively tiny it made no sense to me that all these places could survive in a perfectly competitive environment.

Oh wait a minute, this is Canada.

All the major providers have gleaming storefronts, mostly devoid of customers, but fully staffed and spacious. The secondary providers and off-brand discounters are represented in various kiosks, some positioned right next to each other. Even Best Buy has a small store to offer the latest gadgets. I calculate 20% of the mall's stores are phone related. There's only one barber shop. I get my hair cut way more often than I choose a new phone contract. Talk about retail overkill.

If you were unlucky enough to wander into this chronically underperforming mall you might think the only reason people shop is to buy a new phone. Like, everyday.

I seem to remember buying my last phone directly online from Apple, but I guess I'm the only one who didn't go to Oakville Place.

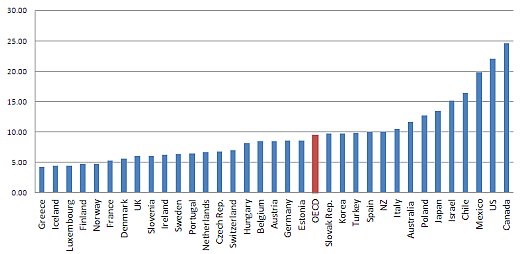

But as the chart below shows, Canada is the least competitive place in the world (it's that big bar on the left) when it comes to cell phone services. Since this chart was created, the US bar (second from the right) has dropped significantly.

International Cell Phone Package Costs

Cell companies who are privileged enough to have Canada as their market have created an oligopolistic revenue structure. We only have the appearance of competition. The massive profits embedded in the average phone contract are supporting lots of wasted retail space. The mall's owner, RioCan, is only too happy to offer it to them. (You may also want to short REI.un after reading the rest of this).

It is with roaming charges that we truly see the magnitude of international uncompetitiveness. In searching for the best deal in roaming for our upcoming trip to Florida, I was less than inspired to discover that I could have the privilege of forking over $6 a day to Bell for the two month trip. No George, I am going to install a SIM chip when I get there and save 70%, thank you very much.

Roaming Charge for 1MB of Data

Dr. Michael Geist*, law professor at the University of Ottawa, has offered research that demonstrates the degree of uncompetitiveness in the Canadian industry. His conclusion was that phone companies are charging higher prices simply "because they can". But I just needed to go to Oakville Place to reach the same conclusion.

I understand the arguments about the geographic challenge of building and servicing network for a country that is effectively 3,000 miles long but only 100 miles deep. That argument held more water during the build-out phase in the early days. Now that the network is complete, however, the argument for higher prices is looking pretty tired.

I guess we've gotten used to being screwed over in this country by the lack of choice. Only two airlines, one national fixed line phone company, one liquor store, and, seemingly, only one electable political party. The economic paternalism that built Canada seems to be stubbornly ingrained in the Canadian consumer. There has been painfully little backlash against the egregious pricing of mobile phone services in this country.

But things are changing fast.

Late last year, in an rare surge of competition, Shaw Communication's new upstart, Freedom Mobile, launched an assault on the entrenched incumbents with a cut-rate data package. Faced with the threat of market share erosion, Rogers, Bell and Telus, followed suit with their own cheap packages in the important Christmas selling season.

The result was a definitive crack in the formerly placid competitive landscape. In the near term, the inferiority of the Freedom network will keep the dominant players' market share erosion to a minimum, but the Canadian phone companies may finally be heading south and taking their 47% profit margin with them. Price-based competition has finally arrived.

Last year, one of the major factors in the chronic undershooting of the U.S. inflation rate was cell phone plan costs. Data package costs collapsed last spring in a major price war that broke out after the auction of expanded spectrum to new entrants. This chart demonstrates how swiftly the pricing structure of an oligopoly can collapse. As with any commodity, the last unit prices all the rest. Looks a bit like $100 oil in 2014-15 doesn't it?

U.S. CPI - Wireless Telephone Services

Shaw will keep investing in their network and I expect them to become even more competitive later this year now that they have the Apple product line. Shaw has deep pockets and a healthy affinity towards aggressive corporate expansion. I wish them nothing but success. They are the telecom equivalent of the U.S. shale producers who have disrupted the OPEC control of oil pricing.

Many analysts are dismissive, arguing that Shaw will be an orderly competitor and join the oligopoly.

A quick reading of Game Theory** economics says differently. One of these 'prisoners' will confess and the rest will eventually capitulate.

The big three cable stocks suffered dramatic underperformance in the last couple of months and have yet to recover. This abrupt break has coincided with a growing aversion to the expensive low-volatility, dividend-rich segment of the market. Rising rates (read last week's blog) will only be a further depressant to this former leadership group.

I am now looking at the short side of the telecom group. Given the downside risks that now threaten mobile pricing, I would 'cell' any rally.

* http://www.michaelgeist.ca/2014/03/wireless-pricing/

** https://www.tutor2u.net/economics/reference/oligopoly-game-theory

Risk Model: 3/5 - Risk On

A last minute rally in the VIX today and an elevated RSI for the XIU of over 70 keeps the model at a relatively tame reading. The U.S. market is terribly overbought with an RSI approaching 90 and the S&P 500 more than 12% above the 200 dma. Canadian stocks are, as usual, more subdued given the lack of an equivalent to the U.S. tax cut, NAFTA threats, and relative weakness in CWS (Canadian) oil prices.

The melt-up scenario is following the script as the U.S. market continues to focus on bullish sentiment and the positive estimate revision momentum, all the while ignoring extraneous factors like Trump's comments on Haiti and fake news missile warnings. As it should be.

Comments