No, Mr. Bond, I expect you to die!

- Bob Decker

- Jan 9, 2018

- 4 min read

Ok, I admit to being a Sean Connery 'Bond' kind of guy. Craig, too rough, Moore and Brosnan, too GQ. Connery was the perfect blend. My favourite Bond film is Goldfinger. Perhaps it's the scene where he plays golf against Goldfinger and switches the ball on him to win his match. I'm a sucker for a a good golf scene in the movies, especially when it involves catching a guy cheating.

The most famous scene in the movie is one that shows Bond at Goldfinger's mercy, strapped to a table, with a laser poised to dismember him. Bond asks if he's expected to talk. Goldfinger deadpans "No, Mr. Bond, I expect you to die!"

Unlike our hero, James, who wriggled off the hook, I expect the 10 yr U.S. Treasury bond to die this year.

Two year yields have already entered a 'bull' phase after decisively breaking out of a 9 year base. (see below) But there is a conundrum. The 10 year yield has failed to corroborate. It has lagged mainly due to the structural bid to these assets that stems from multiple sources. Among these culprits, the Central Banks, with their massive and unprecedented intervention, have morphed the bond market from 'risk-free return' to 'return-free risk'. This artificially created demand is the main reason bonds have not sold off more dramatically.

2 YR Treasury Yield

10 YR Treasury Yield

The resultant flat yield curve is now a somewhat unreliable signal of the market's forecast of inflation, because of this distortion. Although realized inflation has been low recently due to strong deflationary effects from demographics and technology, the cyclical forces for a temporary jump in inflation are aligned nicely. Strong labour markets, a weak U.S. dollar and co-ordinated global growth will dominate the first half of this year.

In addition, the strong bid to bonds has been enhanced by the 'bull market in pessimism' that I have argued has pervaded investor sentiment until recently. The inflows into bond funds following from the 2008 equity panic have been a major depressant on yields.

Global Fund Flows

Now both these supportive elements are at risk of reversing. And by extension, the case for the continuation of the 'TINA' bid to risky assets will be tested.

Central banks have now signalled their intention to close down their experiment as 'asset purchase programs' are being wound down in the Eurozone, and outright reversed in the U.S. This important supply of liquidity is set to reverse.

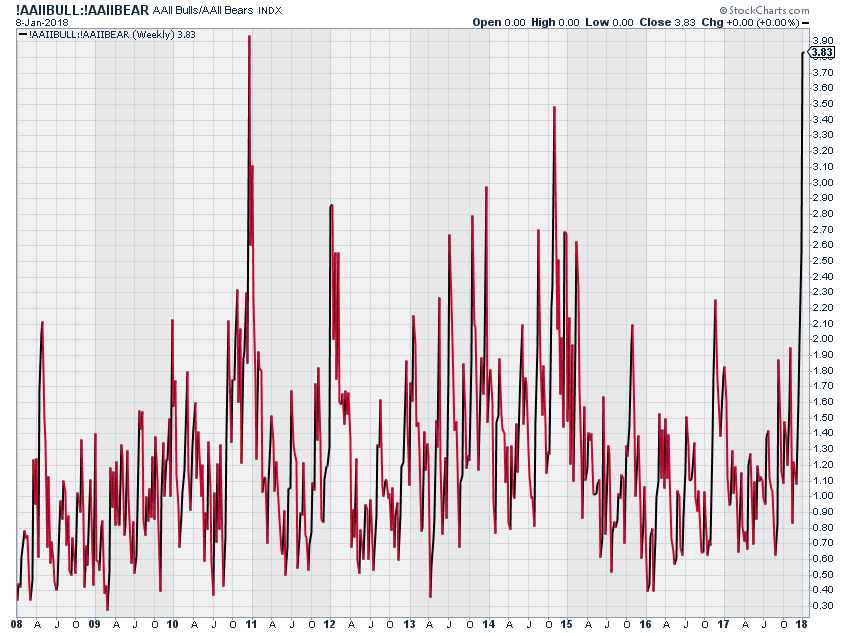

Now, with pessimists in full retreat, the market begins its final phase. My favourite sentiment indicator has been the AAII survey as it is not a 'talking head' opinion, but the actions of real world investors with skin in the game. Last week's reading (3.85) was nothing short of a blow off. ( see below). Pushed decisively off the fence by the Congressional deal on tax reform, these investors signalled their euphoric approval of the deal with an orgy of optimism.

AAII Sentiment Bull/Bear Ratio

This signals a potential for a suicide switch in asset allocation in the coming year, as investors pile into the market late in the cycle. Emboldened by tax reform, and with a strong global macro backdrop, investors have begun the year chasing the 'winning' trade - equities. I have been arguing that the bears, who, fixated on valuation, have been early. Because of the cautious sentiment, and under exposure to equities, I consistently dismissed the bearish case last year.

This last case for contrarian bullishness is finally over.

Seasonal forces are strong in the year's first two quarters, so for now I'm long but more nervous than at any time since the March 2009 bottom.

S&P Seasonality

For now, the market internals, breadth and volume are in good shape. All boats are rising on the back of tax reform. If and when the bond market backs up, the Financials, beneficiaries from rising yields, could spur another mini-rotation to the 'Value" trade, furthering the advance. This move is justifiable, given the margin expansion inherent in a lowered tax rate. But it is a one time phenomenon, likely to be ultimately reversed by President Winfrey (or whoever needs to fix the budget deficit in 2020).

The weak dollar and a recent stabilization of the Chinese markets are potential supports for the rotation into commodities. They are now gaining favour as a diversification play as well as a growth option. Every bull market is a house with a copper roof. I'm long JJC.

As Jeremy Grantham of GMO postulated last week, the market could enter a melt-up phase that would signal a risk appetite peak. With only 'touchy-feely' indicators to go on, this long time 'value hound' is open to the prospect of sentiment induced market bubble. So far his scenario is looking good. For equities, this could set up a 1987 style correction based on the relative value trade between bonds and stocks.

The Fed will have a lot to say about this in 2018, should they become more hawkish, especially when faced with the asset price inflation trade getting bubblicious.

Irrational Exuberance 2.0.

Powell will be under the gun shortly. Let's see if he's game for a fight. Previously, I had wondered about the potential for a yield curve inversion being the catalyst for a market peak. Now I wonder if a blow-off rally, combined with a soggy bond market could present a risk. The 1987 collapse came out of the blue, with a backdrop that included a strong global economy and a 'normal' 2s-10s curve of 100 beeps. It was the relative value trade that killed that market.

As for for bonds, Vince Carter said it best during the the 2000 NBA Slam Dunk contest.

"It's Over!"

Risk Model: 4/5 - Risk On

The sentiment melt up, although reflective of a bubble in optimism, is not in itself a negative element as it supports a prospective inflow of risk capital. Only standing back from the short term nature of this indicator does one see the risk that is inherent in this mass acceptance of the case for equities. The last bull-case contrarian element is gone.

With the U.S. market very overbought, however (11% over the 200 dma) maybe the Canadian market is the one to play now.

The copper/gold ratio is supportive and VIX is dormant.

Oil is slowing down now, and the February seasonal weakness is dead ahead. Buy the dip, should there be one. Commodities are a great diversification this year.

Comments