Head-Fake News

- Bob Decker

- Dec 5, 2017

- 2 min read

ABC News correspondent Brian Ross provided the market a convenient excuse to sell off last Friday. His reporting on the Flynn plea deal erroneously implicated candidate Donald Trump in the Russian election meddling scandal. It was actually fake news. The market recovered by day's end as the ABC issued retractions that effectively exonerated Trump.

Unfortunately for FANG fans, the selling on Monday continued to accelerate. The implications of a successful tax deal, brokered by the GOP over the past week are perceived as more beneficial to the "Trump" trade (Industrials, Energy, Material, Financials) so the rotation trade was on. My call for a short term top was right for the wrong reason.

However, there are more than a few things wrong with this sell-off. The timing is suspicious, coming at the end of the year when the cross-currents in the markets usually are the strongest. Window dressing run-ups, like the one we saw in November are often followed by short, sharp pull backs of profit-taking. The tax deal from congress is more of a corporate benefit than a personal one, diffusing the incentive to wait until January to sell. And the infatuation with Bitcoin is having the perverse effect of creating selling in stocks as risk aversion antennae are raised.

There are also some inter-market red flags. Oil has come off the boil after the bullishness that proceeded the widely expected OPEC extension deal is being unwound. China's stocks are in a post CPC swoon. Re-read my Oct 17th's post for thoughts on the potential for a 'kitchen sink' environment to develop. Any growth acceleration from the tax bill in the U.S., is easily swamped by the growth slowdown potential in China.

As the sportscasters say, 'Let's go to the video'

The stretched relative performance of Growth over Value is correcting from an extreme but still remain in a bull trend:

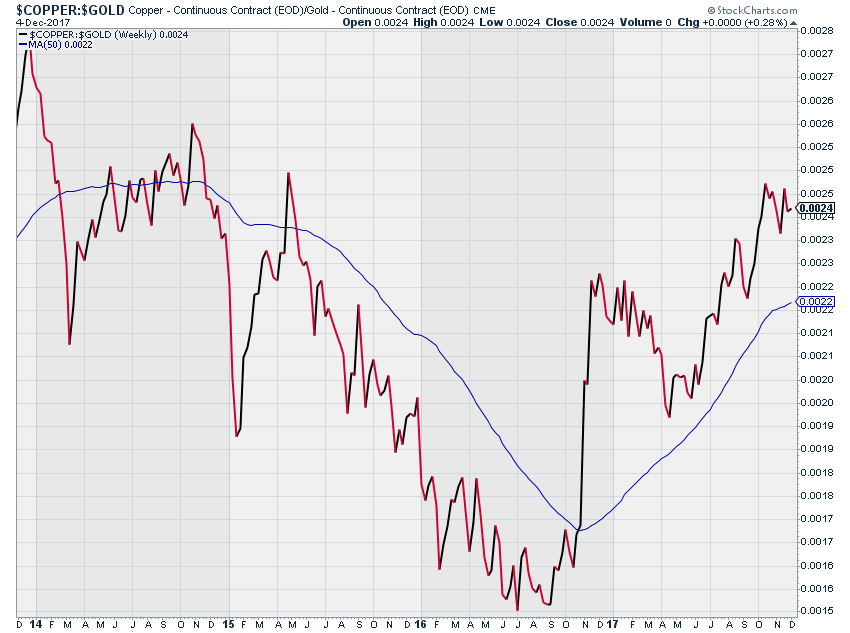

But corroborating action from the bond market and the copper gold ratio are lacking:

Copper is taking the news of a potential Chinese credit crunch hard this morning. Combined with the potential for a strengthening in the U.S. dollar from both Fed rate hikes and a potential capital repatriation wave that will occur when the tax bill gets signed, and the support for the Trump trade disappears pretty quickly.

The market is stabilizing this morning as cooler heads prevail and the rotation trade pauses. Without confirmation from the above two charts ie U.S. 10yr Treasuries above 2.65%, and an accelerating copper price, I'm unwilling to believe the Head-Fake news of the recent cyclical/financial strength.

Risk Model : 3/5 Risk On

Positives:

Although the copper price is weakening, the gold price is weaker and the indicator is still bullish for now. The XIU has worked off an overbought an looks like a consolidating uptrend.

Negatives:

Vix spiked on Friday's news and has yet to correct to a bullish reading and AAII sentiment fell last week on correction fears.

There is talk of a large hedge fund unwind (long tech-short media) that accelerated the rotation trade this week. If the Santa trade arrives it will most likely involve a bounce back in the momentum winners at the expense of the value trade.

Comments