Dog Days

- Bob Decker

- Aug 1, 2017

- 2 min read

As I sit relaxed in a beach chair sipping a cold bevy and turn another page in my Kindle waiting for my thumb to regain its opposable function, I'm getting bored. Long summer days will do that to a brain that's idle. Market action is randomly quiescent and has frustrated the consensus, the "correction" camp. Our model has correctly predicted a summer tradable rally in commodities that has yielded a tidy profit, but only for the nimble. Thanks Dr Copper!

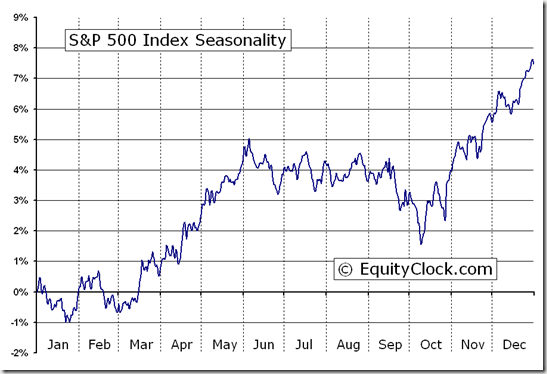

The seasonality of markets has always aligned with my belief in behavioural bias and this year has followed the script very well. Markets have followed the pattern nicely providing a trusty road map for navigating the year to date rally. The Volatility chart is especially interesting as we are soon entering the acceleration phase that peaks in sept-oct.

The risk model, (4/5 bullish), says to stay long for now but I'm keeping a close eye out for a reversal in the more sensitive indicators, especially Vix.

Much has been said about the collapse of volatility recently and I'm not going to add to that din. Except to say that this market is not about fear and greed, but complacency. I couldn't find an update chart of the one below, but the AAII Neutral reading has spent almost two years now hovering around 40% versus its long term 30% average. Currently it's 41.2%.

Two observations come to mind. How do you end a bull market without arriving at a state of euphoria? We need the neutral camp to throw in the towel before the market cycle ends.

Also, how do you correct a market market that has no alternative other than cash? Hence the high level of "neutral" readings. The T.I.N.A. bid is stubbornly persistent.

The answer as always is tight money. Unfortunately for the correction camp,with the latest decline in the Greenback, and the 2s-10s stuck at 90 bps., monetary conditions have actually eased since the last Fed hike.

So keep sipping on that drink with your toes in the water as you while away the dog days of summer, long the market.

As Gordie wrote, gales of November may come early.

Comments